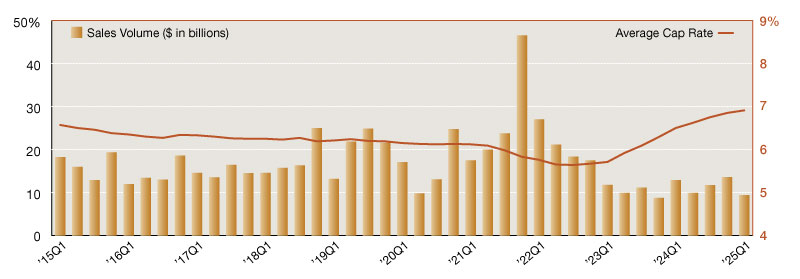

The single-tenant net lease market faced headwinds in first quarter 2025, as transaction activity declined. Total sales volume for the period reached only $9.4 billion, marking a 30 percent contraction from fourth quarter 2024. With one of the weakest starts to a year in recent history, investors continue to exercise caution as they navigate elevated borrowing costs and broader market uncertainty.

Overall single-tenant cap rates edged upward for the tenth consecutive quarter, averaging 6.91 percent at the end of first quarter. This figure represents a modest six-basis point increase from the prior reporting period and a larger 41 basis point rise year-over-year. The steady climb in cap rates reflects the recalibration of asset valuations to align with higher interest rates, which continues to impact investor pricing strategies.

Private investors maintained a dominant position in the net lease sector, comprising 46 percent of all buyers. Institutional investors, now representing 27 percent of the buyer pool, demonstrated a noticeable uptick in activity compared to full-year 2024 levels, especially in the industrial sector. Conversely, REITs reported sharply reduced activity, involved in just 4 percent of the quarter’s acquisitions. Notably, REITs remained completely absent from the single-tenant office segment, underscoring persistent challenges within the sector.

Sector-level trends revealed varied performance. The industrial sector continued to lead in investor demand with $4.6 billion in sales, although this volume was down more than 47 percent from fourth quarter 2024. Retail showed resilience recording $3.05 billion in sales and marking a 9 percent increase quarter-over-quarter despite a 26.7 percent year-over-year decline. Office transactions, on the other hand, fell to $1.8 billion – a staggering 56.2 percent decline from a year ago.

Looking ahead, cap rates are likely to expand further, and evolving buyer profiles will shape activity as investors assess risk-reward dynamics across the net lease landscape, especially as the impact of tariffs, projected interest rate cuts and other market dynamics become clearer.

—Posted on May 30, 2025