Am I a nerd?

Be honest. I can handle it.

At worst, I plainly am a nerd. At best, I’m simply a guy with nerd-like tendencies.

But let me ask you this: what makes me more of a nerd?

(a) The fact that I have every G.I. Joe action figure minted from 1982 through 1986.

(b) The fact that I have a running spreadsheet with monthly inflation, unemployment, and BOC lending rates, and I update it every single month like clockwork.

I suppose I could add (c), (d), and (e) to the list, but I already feel vulnerable enough already.

Tis true, however.

Just as I updated my “PGA Major Champions” spreadsheet on Monday morning after Scottie Scheffler’s victory at Quail Hollow, I also updated my “Inflation, Unemployment, BOC” spreadsheet on Tuesday when the latest data was released.

Like I said, nerd-like tendencies…

But if you have an interest in economics, finance, real estate, or everything in between, surely this is data that piques your interest.

On Tuesday, I wrote about what’s ahead for the last six weeks of the spring real estate market. So it seems to reason than “economic refresher,” if you will, is a logical follow-up.

Let’s discuss…

Unemployment in Canada increased to 6.9% in April, up from 6.7% in March.

This is the highest we’ve seen since September of 2021, which of course was a time in our country where we were still recovering from the COVID-19 pandemic decimating the economy and the job market.

While maybe I’m guilty of making everything political, I wonder how much our increasing unemployment rate has to do with the federal government’s policies.

Are you bullish on the Canadian economy after the latest election result?

What do you think of the federal government’s budget?

Oh, wait, they’re not releasing one…

Don’t forget, we live in a country where our national mail carrier is “effectively bankrupt,” according to a report, and where the federal government has loaned the entity $1 Billion in cash in January, despite their $3 Billion in operating losses since 2018, and yet the workers have decided to go on strike.

Right.

Maybe I don’t know how to look at the unemployment rate anymore, from an economic standpoint, but regardless, that 6.9% uptick is noticeable.

At the same time, inflation declined from 2.3% in March to a mere 1.7% in April, which is the lowest rate since September of 2023 when inflation was only 1.6%.

Media outlets are all reporting the same thing: that the decline in inflation was driven primarily by the removal of the consumer carbon tax.

Oh yeah, that thing…

More importantly, media outlets and economists are all saying the same thing: that the inflation data is misleading because it’s being led by energy, but that “core inflation” is up as a result of tariffs and the trade war.

There’s no shortage of media coverage on this, but I’m going to pull from the following article in the Globe & Mail, which contains a slew of opinions from industry pundits.

“How Tuesday’s Inflation Report Has Shifted Market Bets And Economist Views For Future BOC Rate Cuts”

The Globe & Mail

May 20th, 2025

Lots of great thoughts in here from noted economists.

Many are saying the same thing with respect to the inflation data and what it actually means.

Here are a few quotes:

Douglas Porter, BMO Capital Markets:

“The big relief from lower gasoline prices in April masked an unfriendly inflation picture beneath the surface.”

Andrew Grantham, CIBC Capital Markets:

“Headline inflation suddenly looks less taxing for the Bank of Canada, due to the elimination of the consumer carbon tax and the downward impact of that on gasoline prices, but some core measures remain a concern.”

David-Alexandre Brassard, Chartered Professional Accountants of Canada:

“This inflation reading isn’t the green light the central bank needs to move on rates just yet. It will need more evidence of economic strain before stepping off the sidelines and cutting rates again.”

Andrew Hencic, TD Economics:

“Today’s inflation print is a setback for the BoC and complicates the picture for the path of monetary policy.”

Bryan Yu, Central 1 Credit Union:

“Elevated core inflation underscores the challenges facing the Bank in setting the policy rate going forward.”

–

Now, what does this mean for potential interest rate cuts?

Here are a few other choice quotes:

Derek Holt, Scotiabank Economics:

“There is no way that the BoC should be cutting any time soon, if at all.”

Veronica Clark, Citi:

“While a cut in June is now a close call and will likely depend on details of Q1 GDP data next week, we continue to expect 100bp more of cuts from the BoC this year.”

Nathan Janzen & Abbey Xu, Royal Bank of Canada:

“Our own base case expectation has been that a softening economic growth backdrop will ultimately push the BoC to cut the overnight rate down to 2.25% in the summer (from 2.75% currently) after skipping a reduction in April.”

Jules Boudreau, Mackenzie Investments:

“We predict a July cut for the Bank of Canada.”

Tu Nguyen, RSM Canada:

“The disinflation seen in April’s consumer price data increases the odds of a rate hold by the Bank of Canada in June.”

Thomas Ryan, Capital Economics:

“While this level of underlying inflation is still too high for the Bank of Canada’s comfort, the Bank’s mostly dovish tone in April suggests it is more focused on economic risks, which supports our view that it will cut rates again in June following the recent set of weaker economic data.”

Royce Mendes, Desjardins Capital Markets:

“With the economy clearly weakening in recent months, lower inflation expectations should keep central bankers on track to cut rates 25 basis points in June.”

David Doyle, Macquarie:

“While we continue to see intermittent cuts of 75 bps from the BoC by yearend, these firm data lead us to push out the timing of our next expected cut to July (prev. June).”

–

The Globe & Mail article was a cornucopia of thoughts and opinions on the current economic climate in Canada as well as the potential for interest rate cuts or holds.

Read the article in full if you have time.

On Tuesday, I also attended an economics update webinar with Jason Friesen of Outline Financial.

Thanks to Jason and his team for providing us with the following slides which will offer even more opportunity for economic banter and subsequent analysis.

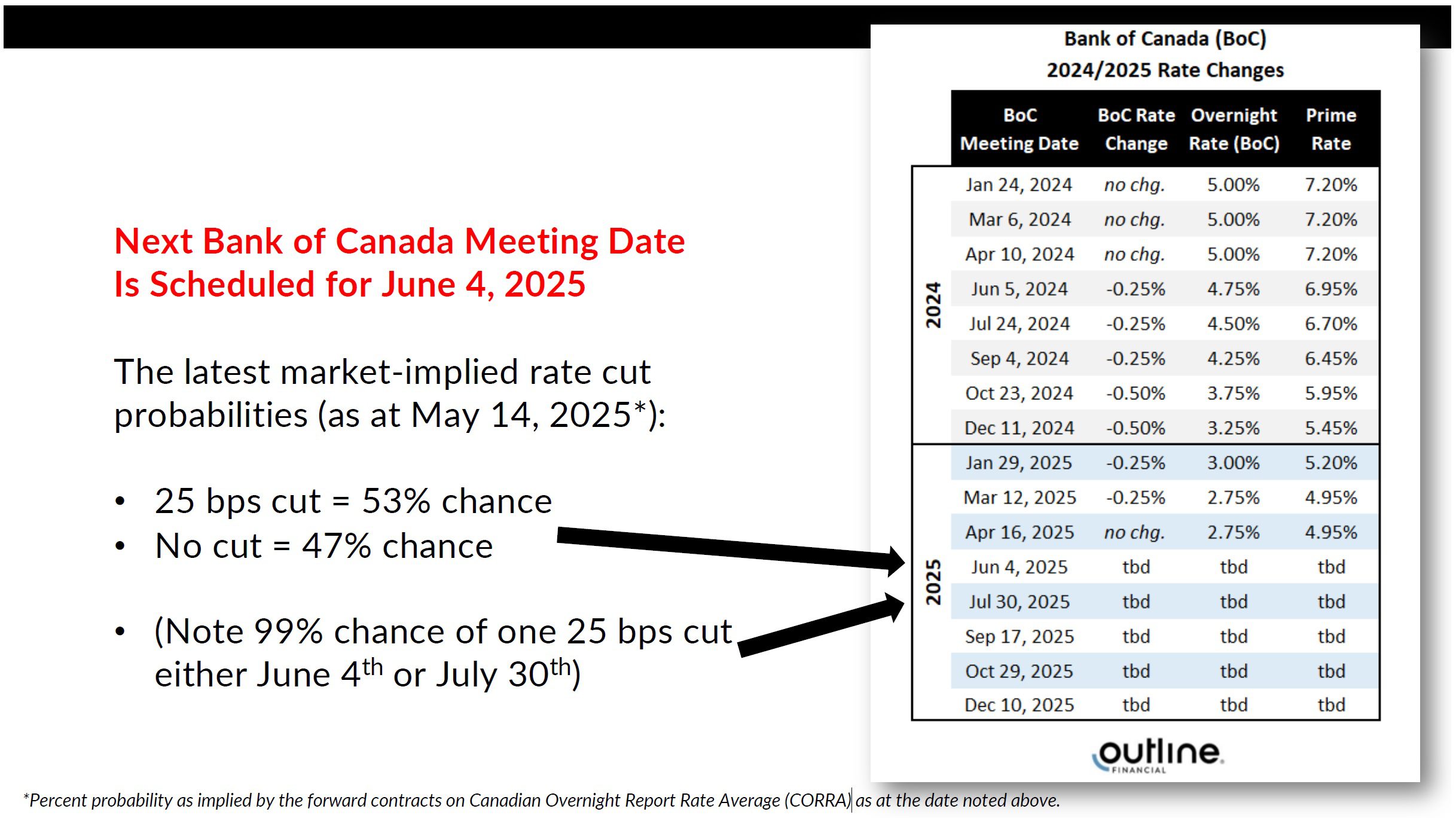

First, let’s look at the “probability” of rate cuts:

A little more than “fifty-fifty,” as it stands now.

But the consensus seems to be that a rate cut in June or July is coming, no matter what.

As noted above, Vice President and Head of Capital Markets Economics at Scotiabank, Derek Holt, said: “There is no way that the BoC should be cutting any time soon, if at all.”

With a 99% probability of a rate cut in June or July, I wonder how that comment will age. Maybe he knows something that the other 99% don’t.

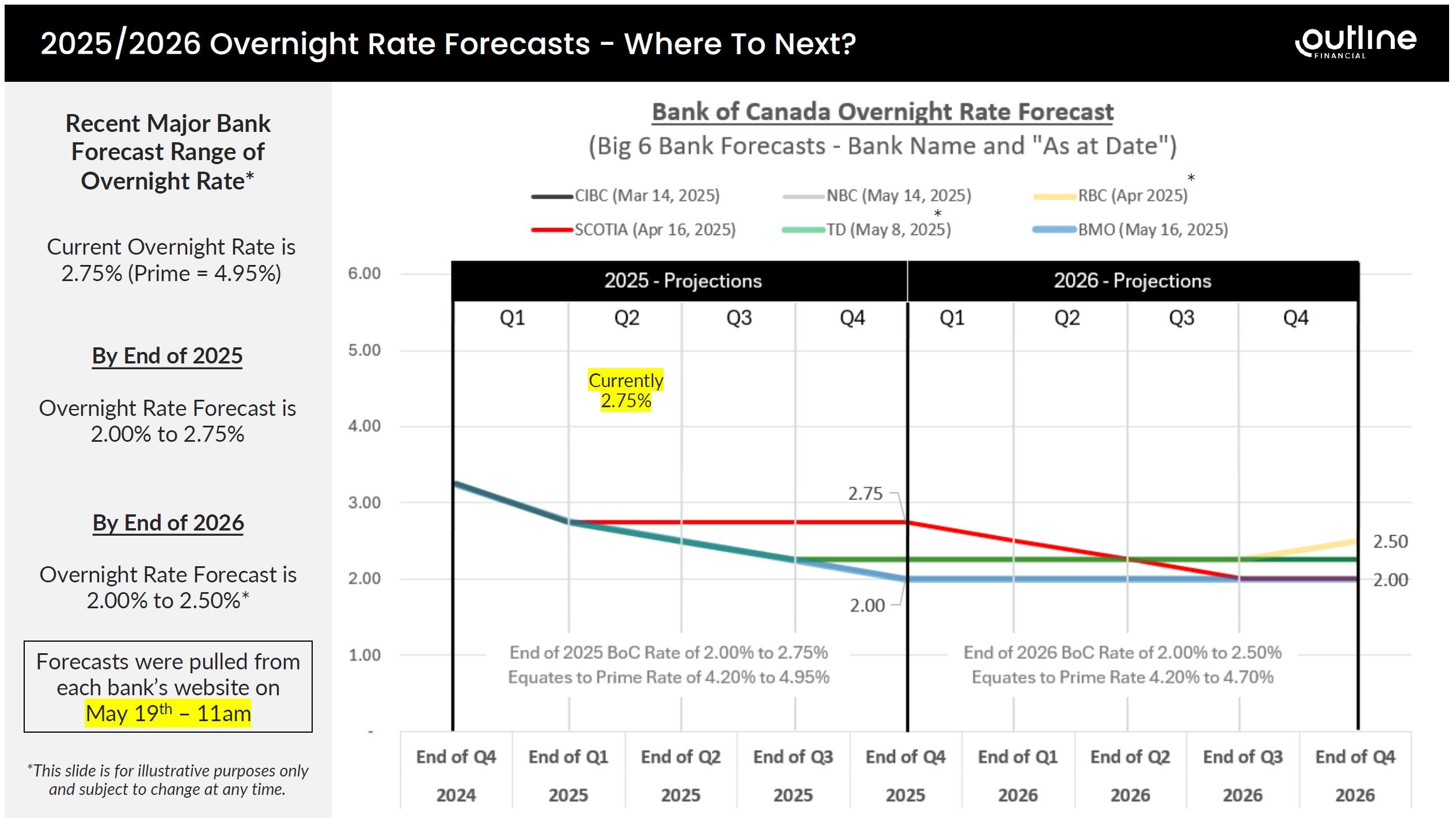

My favourite slide in these presentations is always with regards to the “Overnight Rate Forecasts.”

Yes, I’m like everybody else who wants to see lower interest rates.

And when we met in this space in January, the Big-Six banks offered the following projections for where the overnight lending rate would stand by the end of 2025:

Scotia: 3.00%

BMO: 2.50%

TD: 2.25%

CIBC: 2.25%

NBC: 2.25%

RBC: 2.00%

Here’s an updated look at the banks’ predictions:

Scotia has revised its prediction to 2.75% from 3.00%.

BMO has revised its prediction to 2.00% from 2.50%

TD, CIBC, and NBC have all held their predictions at 2.25%.

RBC has held its prediction at 2.00%.

As far as 2026 goes, it’s a lot more of the same, except Scotia has rather notably revised its prediction to 2.00% from 3.00, and not only that, RBC is predicting an interest rate increase from 2.00% to 2.50%.

Isn’t it a little bit early to be talking about interest rate hikes at the end of 2026, when we’re still talking about interest rate cuts in the middle of 2025?

Well, as I said, those slides always provide for great banter!

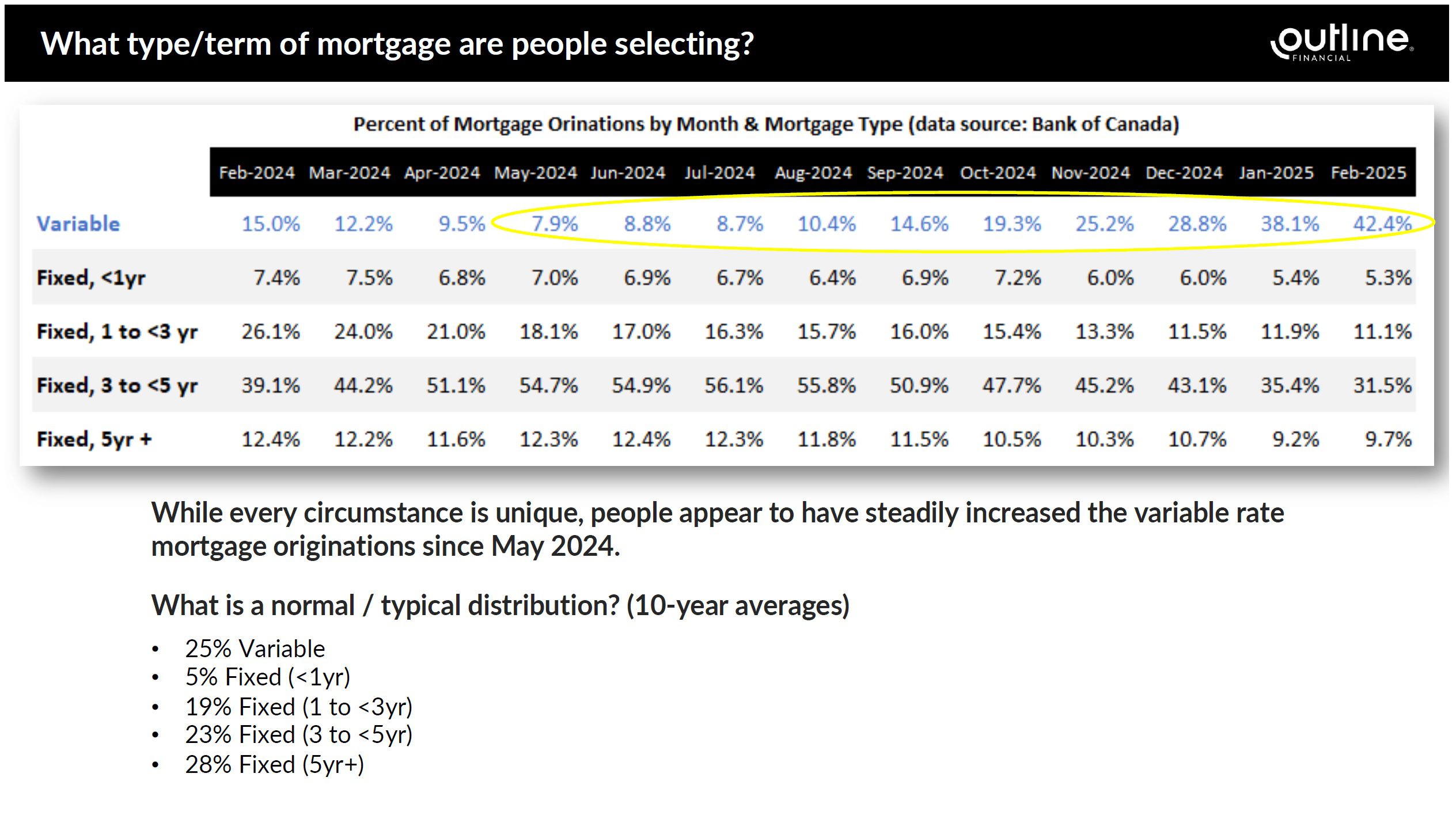

The slide that I found equally as interesting is with respect to the types of mortgages that borrowers are selecting.

Have a look:

Tell me that this “comes as no surprise,” but I think there’s more to it than that.

I spoke to somebody who, rather amazingly, took a 5-year, fixed-rate mortgage of 5.19% two years ago at what she described as “the height of interest rates,” and subsequently blames her mortgage broker for providing her with poor advice.

I agree, but she’s not alone in that. Nobody is alone with respect to any product in the mortgage market, since there truly is a “borrower for everything.”

But look at how things have changed in a year!

April of 2024 – 9.5% of borrowers took a variable rate mortgage.

April of 2025 – 42.4% of borrowers took a variable rate mortgage.

Wow, what a dynamic time in the mortgage market! Brokers must be on pins and needles at all times.

Then look at the proportion of people taking a 3-year or 4-year fixed rate mortgage. This number peaked at a whopping 56.1% of borrowers in July of 2024, and that figure plummeted to a mere 31.5% in only seven months.

Call the change in the proportion of people taking a 5-year, fixed-rate mortgage an “uptick” from January to February, as it represented an increase from 9.2% to 9.7%, but overall, I think we can agree that we’ve essentially bottomed out here. I fully expect that by the time we re-run this data in 3-4 months, we’ll see that figure increase dramatically.

Now, for those who want to see the above data on a longer chart, as the preceding only goes back to February of 2024, have a look:

Who was taking a variable rate mortgage back in November of 2019, right?

Then again who in the WORLD is taking a 7-year or 10-year term today?

Picking a mortgage is kind of like dating. Feel free to insert your own analogy here. Best one wins a G.I. Joe action figure…

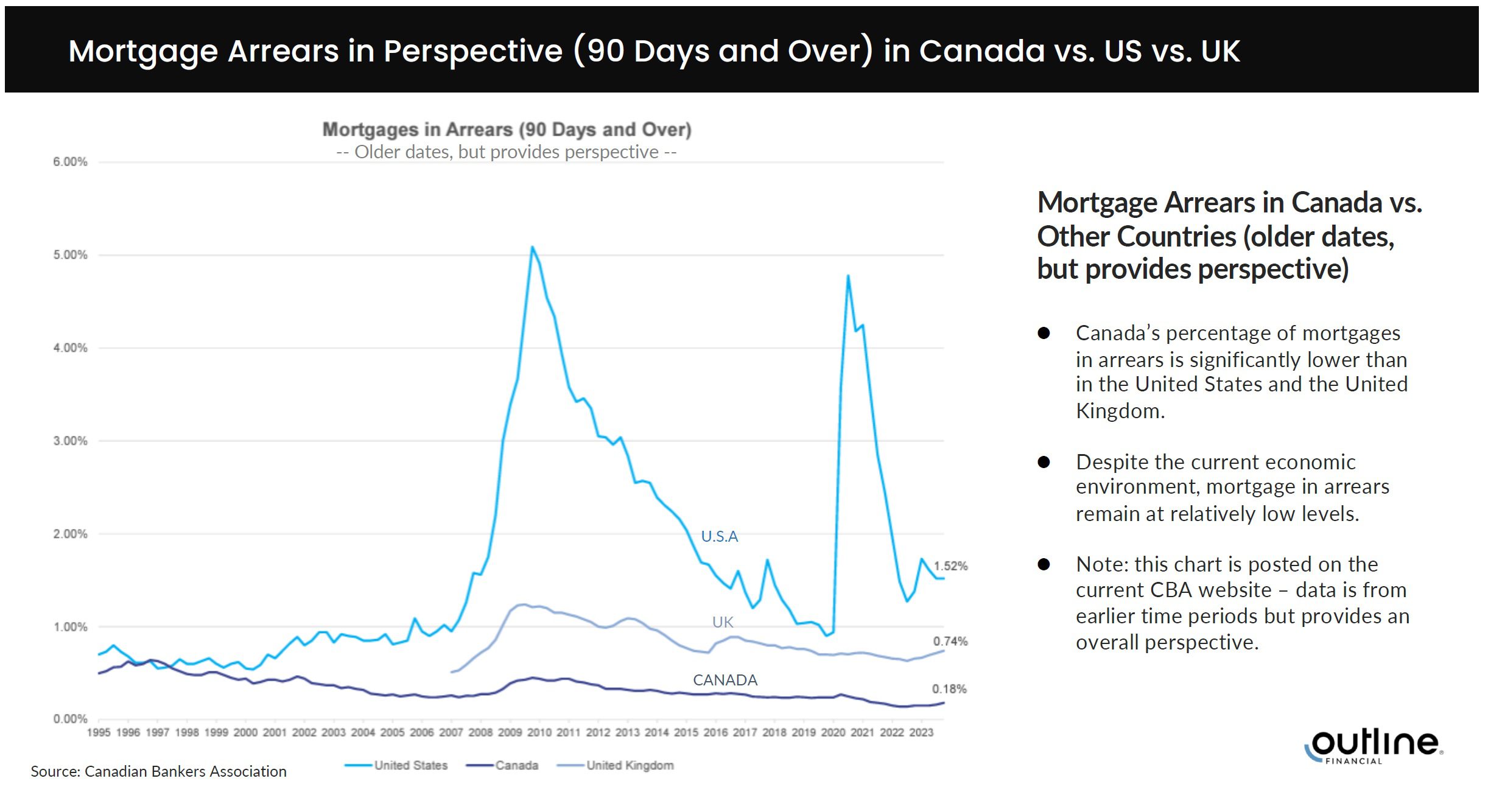

Last, but not least, you know I love to talk about Mortgage In Arrears.

March 31st, 2025, I wrote: “Are Mortgage Delinquencies On The Rise In Canada?”

I made the point that while the media ran misleading headlines about delinquencies “doubling” in the final months of 2024, they neglected to mention that delinquencies were rising from all-time low levels.

Here’s a chart that plots Canada’s delinquencies against those of the United Kingdom and the United States:

There’s hardly anything united about those three figures; Canada stands alone.

Once again, this speaks to the resiliency and safety of the Canadian banking system, but I’m sure we haven’t seen the last of the headlines about mortgage delinquencies “spiking.”

So what’s the hot topic here?

Inflation?

Core inflation?

Unemployment?

Interest rates?

Tariffs?

Feel free to nerd-out for a moment and we can get back to pretty pictures of houses another day.

Okay, but seriously, about this G.I. Joe thing….