Despite soaring equity markets and resilient household spending, Canadian consumer confidence continues to erode. A new report from BMO Capital Markets explores the growing disconnect, suggesting consumer anxieties may not be rooted in actual economic weakness. However, if sentiment doesn’t improve it can slow the economy—triggering the concerns they fear.

Canadian Households Feel Gloomy, But TSX Has Never Been Better

Canada’s largest stock market is the latest data point to ignore eroding consumer confidence. The TSX kicked off the week hitting a record high on Monday, and is up 5% year to date. It’s not often that investors are feeling good about the future of the economy, but households aren’t.

“Suffice it to say that this runs against the common narrative surrounding the economic outlook, which is nothing short of dire among consumers and businesses,” said Douglas Porter, chief economist at BMO. “This gap has been well-noted for months now, but has become even more extreme in recent weeks with the snappy rebound in the TSX since early April.”

The TSX follows a long list of positive macro indicators that are outperforming, including the output gap. The narrow output gap implies the economy is running near its full capacity, which is behind that soaring inflation. Even with households generating significant economic activity, consumer confidence has fallen to record lows on tariff and trade concerns.

Consumer Confidence Vs Spending: Historically Close, Now Diverging

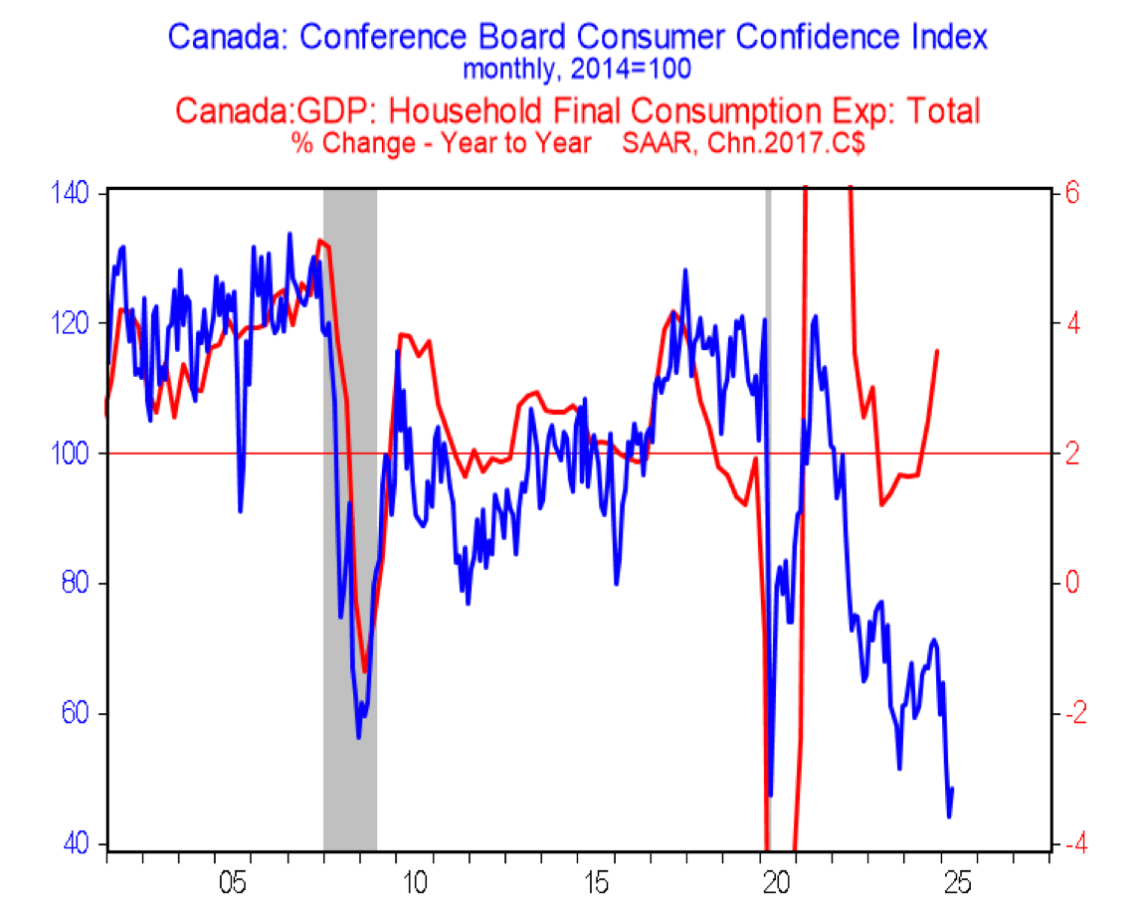

Diverging macro data and consumer confidence has BMO pondering if these surveys are even a good predictor of the economy. They charted consumer confidence against household spending, and found historically it has been. In the chart below, it’s clear the two were extremely close for most of history. A larger gap forms post 2021, but the trends generally move in the same direction until the end of 2024.

Source: BMO Capital Markets; Statistics Canada.

“As the accompanying chart suggests, confidence figures at least used to be very good coincident indicators of real spending activity,” notes Porter. “The pandemic clearly unsettled things (including the need to clip the chart’s scales surrounding that period.”

Canadian Households & The Risk of A Self-Fulfilling Prophecy

He suggests the burst of inflation is where things start to rattle consumers. Though the rattling hasn’t impacted their spending much, with the bank estimating real spending will show 3% year over year growth in Q1 2025, after April retail sales were firm with an 0.5% advance.

“The bottom line is that while we can’t ignore the confidence numbers, they appear to be sending a much more negative signal than the reality on the ground. Blame social media?” Porter speculates.

Policymakers whipped households into a panic, and now they’re struggling to convince them reality is correct me. If consumers continue to embrace slowdown concerns, they won’t spend as freely. Ironically, this can trigger the economic recession and slowdown they’re worried about.