“Aaaand…..they’re off!”

Horse-racing fans will know these are the three most exciting words in the sport, although “….at the line” can be just as exciting.

I’m no horse racing fan, but it was wild to see Journalism come from way behind to win the Preakness over the weekend, running at what looked like a speed double the pace of the lead horse at the time as they sprinted down the home stretch.

Ah yes, “the home stretch.”

Is there a horse racing term that’s become more of a commonly-used metaphor than “the home stretch?”

Geez, I wish I was in the home stretch of this blog post right now so I could go watch the fireworks, but alas, I’m still lining up in the gates.

I might not be a horse racing fan, but interestingly enough, it’s ingrained in my D.N.A.

My great-grandfather was a horse breeder. Or trainer. Or racer. Honestly, I’m not entirely sure.

But I do have a few relics from yesteryear, including this magazine which I keep among all the other memorabilia in my office/man-cave:

That’s my great-grandfather, J.J. Fleming, and his prize racehorse, Teddy’s Sister.

Thanks to Wikipedia, I solved the riddle in about ten seconds; my grandfather was not a trainer, or a racer, but rather an owner. Teddy’s Sister won the 1954 Valedictory Stakes, among other things, as noted in my rather late Internet search…

The modern-day horse racing world is fascinating to me.

All those people and their ridiculous hats. The sheer amount of wealth involved. The history.

But racing a horse hasn’t really changed in 150-years, has it? You get on the horse, ride fast, and that’s about it. Is there another sport that remains as similar today to what it was centuries ago? I mean, maybe archery? Except, while shooting a bow-and-arrow is the same, the bow, the arrows, the target, and the technology therein has changed dramatically.

The finish of any horse race also fascinates me but not for the reason you might expect. Sure, watching a horse win is interesting, but I find it equally as interesting to watch a third of the field pull up when it becomes clear that those horses have no chance of placing. Perhaps the strategy wasn’t correct or maybe the horse or the jockey just didn’t have the strength, but either way, you never really notice how many horses quit with several hundred meters to go until you’re shown the long-angle replay minutes later.

As we approach the home stretch of the spring real estate market, there are bound to be winners and losers.

There will be different strategies, and different levels of success and failure, and like any good race with a home stretch, there will be those that pull up well in advance.

The post-Victoria Day market goes by very quickly!

Sure, there are six full weeks between now and July, but if you’re the seller who targets the first week of June to list, then you have an offer date, then the offer date doesn’t work, suddenly, you’re only two weeks out from summer!

Yes, there is a summer market, but most sellers try to avoid it. The school of thought is that once the kids are out of school, the parents don’t have the time, wherewithal, or desire to focus on their real estate search.

So pack these six weeks into a vice, give the handle a turn, and you’ll know what the post-Victoria Day real estate market feels like.

To be more specific about the inner workings of the market, here are some points to consider…

–

There will be a flood of new listings.

Imagine being that horse, lined up at the gates, and having that gate fling wide open.

“I need to run as fast as I possibly can,” the horse thinks.

Is this instinctual? Is this a pattern of learned behaviour?

Imagine what it’s like to be stuck in the middle of that pack, with thousands of pounds of brute force smashing down on the ground every millisecond. Imagine the sheer power exerted!

What’s the mindset of the horse and the jockey?

Is it fear? Is it excitement?

Intimidation and pressure, or strength and stamina?

The same thing happens after Victoria Day when our real estate market is flooded with new listings. Many sellers use the long weekend as their “final push” to prepare and thus hit the ground running on Tuesday or Wednesday thereafter. But a lot of sellers have this same idea and the result is often more competition than in March or April.

For the sellers and listing agents who have the best properties in the most sought-after locations and price points, which are presented in perfect shape, they need not worry. They’re the front-runners with the size, speed, and stamina to get to the finish line.

But everybody else is going to find it difficult to navigate that intense pack that’s coming hard out of the gates.

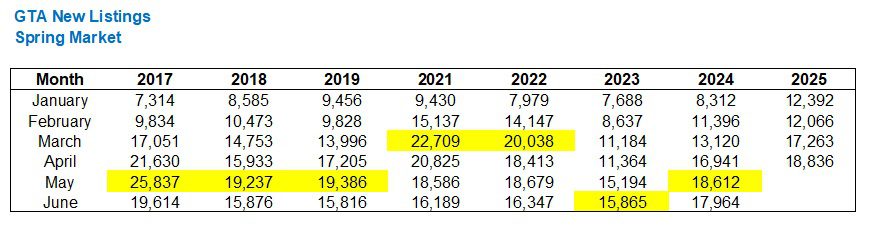

Here’s a look back to 2017 (not including 2020 because of COVID) with respect to the peak of new listings in the spring market:

May and June represented the peak in five of seven years.

I expect the same to happen this year, and I think it’ll happen literally the first day back – which is today, Tuesday after the long weekend.

There are a lot of active buyers out there and many have made offers on houses already and lost, and many are seeing May and June as their last chance to get into the market and close on the purchase before fall. Whether or not these buyers are aggressive enough to turn the market in sellers’ favour remains to be seen…

–

There will be a flood of re-listings.

Many of the “new listings” to hit the market in the next six weeks will actually be re-listings, ie. properties that were previously on the market but are now listed anew.

Having said that, there are two types of re-listings that we’ll see:

1) Properties that were only listed a week ago, had a failed offer night, and now are coming out again at a “new and improved price.”

2) Properties that were either sitting on the market for months and now have decided to re-list at a new price, or properties that were listed in January, February, or March, were removed from MLS for a while, and are now trying the “last hurrah” before summer.

I don’t expect these listings to make an impact, however.

Well-priced, in-demand listings sell. Period.

Over-priced properties that are not sought-after do not sell. Simple.

And as we have discussed throughout the last five months here on TRB, there are a lot of sellers who are either overvaluing their properties, refusing to put time and money into them, and/or assuming that there’s substantial demand for the property type when there is not.

Consider your typical $1,300,000 starter home on the west side or the east side, which was listed for $998,000 with an offer date, but didn’t sell. This property, re-listed for $1,299,000 will ultimately sell in the next six weeks. But when I put “new and improved” in parenthesis above, it’s because many of these sellers will take that same property and re-list it for $1,400,000, and the market simply won’t accept that.

On Victoria Day, I met with a builder who is looking to list his new project for sale. The one point that I wanted to drive home, above all else, is that buyers don’t like properties that have been listed eight times! In fact, this backfires. Buyers typically reject this type of property because they assume there’s something wrong with it. Or, in the case of a luxury home in the midtown area, buyers will decide, “I don’t want to be the person who finally bought this house, which has been for sale for eighteen months.” They see and feel a stigma, and snobby or not, they don’t want to meet a neighbour at the playground in three months, tell the neighbour where they live, and then have the neighbour say, “Oh you bought that house!”

This should represent basic buyer psychology, and yet most sellers don’t see this.

I had a client reach out over the long weekend and ask me about a home in The Annex which has been up for sale for two years! My first thought: “This thing is over-priced.” My second thought: “There’s something wrong with this house.”

How can you think anything different?

Tis the season for re-listings, and come June, browsing new listings on MLS is going to have an air of familiarity to it…

–

Many sellers will rush to market – and it will be noticeable.

Have you ever gone into a new home and found “the door to nowhere?”

I have. Many, many times…

Picture a newly-built house that looks pretty good until you get to the family room at the back of the house and find that there’s a door to the yard but no deck!

Alas, the door to nowhere.

Every year at this time, we see properties listed that are 95-99% finished and I think it’s a huge mistake.

Buyers don’t want to walk into a $2M, $3M, or $4M home and find that there’s no back deck, but rather there’s a sawed-off hockey stick jammed in the sliding door track and a hand-scrawled sign that says “DO NOT OPEN.”

Buyers don’t want to see a backyard that belongs to the 1960’s bungalow that was in place until the home was torn down in favour of this new McMansion.

Buyers don’t want watch their step as they navigate that outdoor space, afraid of stepping on a nail, while dodging mounds of dry concrete and other construction debris.

We often complain that, in the pre-construction condominium world, a particular unit might be finished but the common elements of the building are not. So consider what impact it has on a buyer when the house is beautifully finished but the front yard isn’t landscaped, the driveway hasn’t been paved or had interlocking-brick installed yet, and the back yard is non-existent.

The future promise to complete the outstanding work isn’t enough.

Buyers want to know what they’re getting. They want to see it. They don’t like guessing games.

Not only that, there’s a certain element of trust involved that the outstanding work will be done properly and at the same level of workmanship as the rest of the house.

And I’m only using exterior issues as an example. We see lots of 95-99% completed houses listed for sale with kitchen appliances missing or a basement shower still needing to be tiled.

If you’ve ever been through a renovation, or better yet – if you’ve ever built a house, you know that it’s never done on time.

So consider the builder who targeted the month of April for completion of his new project only to find that it’s looking more like July.

A lot of these folks are going to be listing over the next six weeks and many of them will be offering homes that are incomplete…

–

Offer dates will have a lower success rate.

How many blog posts have I written so far this year that deal with offer dates?

It’s a topic that simply won’t go away, but for good reason.

Many properties are being listed with offer dates – that shouldn’t be!

Other properties are being listed with offer dates – that should be, but the seller, listing agent, or both are taking steps to ensure the house doesn’t sell. Case in point: one of my teammates submitted an offer on a house last week amid six other bids. After some lengthy back-and-forth with all parties involved, the listing agent informed everybody that they weren’t accepting any of the offers and that they were re-listing at a higher price.

I fully expect that house to be re-listed again…

….in September…

On a long enough time horizon, the success rate on “offer dates” will correlate directly with the absorption rate in the market. It’s simply a function of supply and demand, and when you have fourteen offers on a home, suffice it to say, that house is far more likely to sell than when you’ve under-priced the property and have received only one bid.

However, in a post-Victoria Day market where typically listings spike, success rates on offer dates will decline.

This was especially true in 2024 when I personally witnessed the success rates of offer dates on the east-side, in the starter-home price point drop from about 50% in April down to about 10% in June. I’m not making these statistics up either. I had one tricky listing where I tracked all the offer dates below $1,400,000 and their success rates. I shared this with my seller-clients in a Google Drive worksheet in Excel. The success rate dropped about 5-8% per week, every week after Victoria Day! This was so exact, you could set your watch to it.

By the time we hit end-June, maybe one out of ten offer dates was producing a sale that night.

As I said last year around this time, “the cream rises to the top.”

The houses that do sell on offer date, even in a tough market, are going to be the best offerings and/or the ones under-priced the most. Many people don’t want to believe it, but extreme under-listing can work. One of my team offered on a house two weeks ago, listed at $849,000, then received twenty-two offers and sold for just over $1,200,000. Now, to be fair, we figured this was a $1,200,000 house from the start. But had it been “under-listed” for $999,900, would it have attracted the same amount of attention?

One of the by-products of a lower success rate on “offer nights” is that as soon as the buyer pool notices, they’ll start taking more of a wait-and-see approach. Over time, this might mean some buyers’ “strategy” is to simply wait out all listings with offer dates. But that remains to be seen…

–

Agents will get “creative.”

You can read “desperate” if you want to, but that’s not entirely the case.

It’s also like confusing “incentive” with “bribe,” right?

Just consider how, for many years, condominium developers offered ridiculous 4%, 5%, or even 6% commissions to agents who would bring buyers into sales centre, especially when those sales centres were having trouble moving units.

Incentive or bribe?

Don’t answer that…

Likewise, I often see listing agents offering increased buyer-side commissions when a seller absolutely needs to sell. This isn’t exclusive to a May/June market, of course. It can happen year-round. But as we find ourselves in the home stretch, I expect to see several instances of over-priced homes not being reduced but rather where the commission to the buyer agent is increased.

We also see an uptick in things like vendor-take back mortgages being offered, even though virtually no buyer ever accepts, as well as advertising what’s left on a rock-bottom, five-year, fixed-rate that can be “assumed.”

Will we see an uptick in the number of ice cream trucks being rented to sit outside of stale listings at open houses? Hopefully! Here’s an idea that my team and I have latched onto, for what it’s worth.

Unfortunately, “creative” can also be used sarcastically to describe bad business practices, like listing a $2,000,000 home for $1,599,000, without an offer date, leaving it on the market for six weeks, and simply refusing any offer of the list price while berating the buyer agent for “not understanding market value.”

Many agents think that the only way to win the race is to create your own set of rules, but they don’t realize they’re still running the same race as everybody else, and the finish line doesn’t move…

–

We will see many properties listed for sale and for lease.

This is not the best way to sell real estate.

Perhaps this is area-dependent, but outside of condos and starter homes, I would say that the buyer pool is finicky and, at some times, snobby. There are many buyers at higher price points who don’t like any property with a stigma.

A property listed for sale and for lease might not seem stigmatized to you, but to many, this feels like a “builder house” or an “investment property” and not a warm, loving, cherished “family home” where one chapter is ending and another is beginning.

Yes, I’m romanticizing it. But I work with buyers and I know how they think.

Down the home stretch of this spring market, we’re going to see many prospective property owners list both for sale and for lease in an attempt to “hedge their bets.” If the market for sale isn’t strong enough and they decide to keep the property and lease it out, then they’ll want to be on the market for lease now and not later.

–

This year has absolutely flown by!

No matter who you are, despite your age or occupation, I’m sure most of you can agree.

It’s going to be June in less than two weeks, I simply can’t get over it. Weren’t we just shoveling snow?

Best of luck to all market participants, buyers or sellers, over the next six weeks.

Now, somebody please get out their bugle…