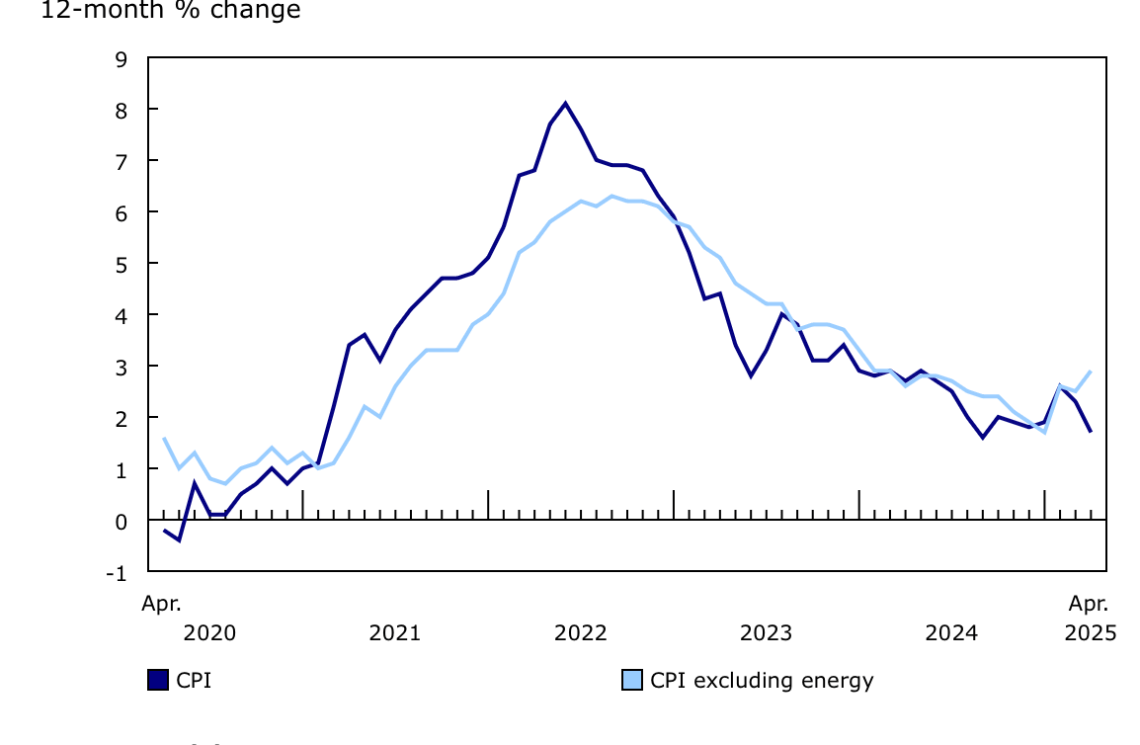

Canadian inflation slowed last month, though most people are unlikely to have noticed much savings (if any). Statistics Canada (Stat Can) data shows the headline Consumer Price Index (CPI) slowed in April. It was a result of last month’s removal of the consumer carbon tax, leading to an abrupt but temporary decline. However, a look beneath the headline data reveals the Bank of Canada’s (BoC) preferred measure of inflation is accelerating, and breached the central bank’s upper tolerance band.

Canadian Headline Inflation Falls After Carbon Tax Removal

Canadian headline inflation showed a healthy reduction, due entirely to the removal of a tax. CPI annual growth fell to just 1.7% in April, a sharp drop from the 2.3% reported a month before.

The decline was due almost entirely to the 12.7% drop in energy prices—the result of ending the carbon tax. It was partially offset by food prices, which saw annual growth hit 3.8% last month, up from 3.2% in March. It was the third consecutive month food prices accelerated, outpacing headline CPI.

Those hoping that slowing headline inflation may be good news for rates are in for a disappointment. Ending the carbon tax had a disproportionate impact on the headline model, temporarily obfuscating the general acceleration of price growth.

Excluding volatile energy prices, inflation accelerated. CPI ex-energy rose to 2.9% for April, up from 2.5% in March. This implies the underlying inflationary pressures persist, and monetary policy is struggling to rein in inflation.

Source: Statistics Canada.

Bank of Canada Preferred Measures of Inflation Shows Acceleration—Above Policy Tolerance

The BoC-preferred Core inflation measures remove the most volatile components of inflation. By reducing the impact of a handful of volatile movements, the central bank can better understand the influence of monetary policy on price.

CPI Core accelerated and has breached a critical level. Annual growth of CPI-Median reached 3.2% in April, up from 2.8% a month before. CPI-Trim also climbed to 3.1% last month, up from 2.9% in March. Both measures have breached the central bank’s upper tolerance band, implying inflation has slipped out of their control.

The market responded by trimming the likelihood of another rate cut to just 40% for June. On one hand, the BoC is seeing rising unemployment and weak household consumption, which should slow inflation. On the other, credit growth has been robust and inflation is now outside of the target. It would be bold for the central bank to dismiss rising inflation as a transitory trend twice in less than 5 years, but not exactly surprising.