Is it the wolf in sheep’s clothing?

Or is this a case of the sheep in wolf’s clothing?

Maybe I lost you in the analogy.

Maybe you just want me to get to the TRREB stats already.

Maybe you wish I would stop writing each individual sentence on a new line.

But however you want to look at this, perspective is important in this market. As is the case with any data set, you can interpret the numbers as you see fit, draw your own conclusions, and compare and contrast those thoughts, opinions, and takeaways with others.

There’s a very fine argument to be made that the real estate market is in poor shape and there’s pain ahead.

But there’s also an excellent argument to be made that the worst is behind us.

As I said: it’s all a matter of perspective. Feel free to make a “top five list;” two, in fact. One will comprise the top five reasons or statistics that show the market is in poor form, and the other will represent the top five reasons for optimism.

“Reasons for optimism,” eh? So says the pessimist…

While I fashion myself a realist, I’ve also become cynical of late. I wouldn’t say that my glass is consistently half-empty but rather that I’ve grown to question the nature of things at every conceivable opportunity.

Case in point: I question why the market has been slow so far in 2025.

The bears will laugh at this as they believe the answer is obvious.

Newspaper pundits will suggest that Toronto “needs” a 50% correction in prices to “restore affordability.”

Critics will point to age-old metrics like debt-to-income ratio and the ratio of increasing wages versus increasing real estate prices, but I’ve spent the last fifteen years debunking the significance of those measures in our city today.

With a significant decline in interest rates that has “restored affordability,” I would once again question why the 2025 real estate market has been slow through the first four months.

Personally, I think it has less to do with the intrinsic value of real estate (ie. the theory that prices are still overblown) and everything to do with consumer confidence.

Raise your hand if you enjoyed the recent federal election?

Well, I suppose if you voted for the party that prevailed, your hand could be raised.

But regardless of the outcome, I don’t know whether any of us can say that we really enjoyed the political turmoil and uncertainty that has plagued our country for the last four months, or dare I say the last year?

All elections are difficult.

Most elections are divisive.

But I don’t recall a more divisive election than the one we just experienced, and although the election is now behind us, there’s still lingering bitterness, political jockeying, and grandstanding among constituents and civil servants alike.

While approximately 43.7% of the country was satisfied with the outcome of the last election, I can confidently say that 100.0% of us are glad it’s finally over. You could almost feel a collective sigh of relief the next day, even among those who were dissatisfied with the outcome.

Attack ads are hard to watch. Sound bites are difficult to process. But uncertainty is the hardest emotion to endure during an election cycle, and every man, woman, and child in this country was mired in uncertainty from the moment this election was called back in January.

Couple this election with that of the Provincial Election here in Ontario back in February, and then feel free to add the uncertainty, doubt, turmoil, and downright paralysis handed to us as a result of the relationship (or lack thereof) between the United States and Canada over the last four months, and it’s any wonder why consumer confidence is at an all-time low.

Consumer confidence – as in, say, buying your daughter a Barbie on Amazon?

No.

But consumer confidence in the stock market? The real estate market? The economy in general?

I don’t know that I’ve seen such an incredible crisis of confidence since the pandemic in March of 2020.

But that’s also why I think that the real estate market has a chance to turn around.

I’m not looking to paint a rosy picture on this, nor am I going to suggest that we’re heading back to a seller’s market, but surely with a provincial and federal election out of the way, it’s fair suggest that perhaps the worst is behind us?

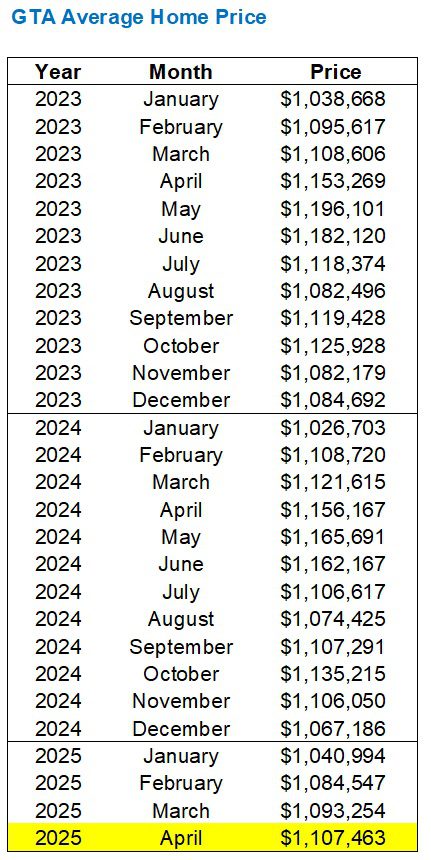

The average home price in the GTA rose a modest 1.3% month-over-month, from March to April, and surpassed $1,100,000 for the first time since November:

That’s right; we’re now back on par with November.

But is your house worth the same, more, or less than it was in November?

It really depends on the market segment.

I just sold a house in Leaside for over $4,000,000, with two buyers bidding the price a quarter-million over asking. I don’t think that would have happened last fall.

But if you’re looking to sell your 450 square foot condo in King West, you’re probably wishing it was November.

Year-over-year, that $1,107,463 price is 4.1% lower than the corresponding price in April of 2025.

For reference, the year-over-year decline in March was 2.5%.

Are we seeing the market decline at an increasing rate?

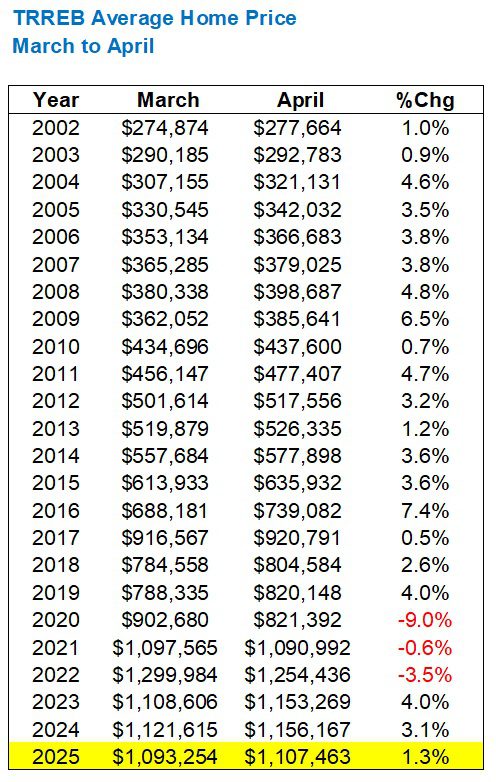

What should we have expected to take place over the last month, based on historical data?

Previous to this year, the average home price in Toronto rose from March to April 20 times in the previous 23 market cycles:

Yes, the average home price did increase last month, but only by 1.3%, which pales in comparison to the 3.1% we saw in 2024 and the 4.0% we saw in 2023.

Had the market risen accordingly, we’d have seen the average home price hit $1,127,145 or $1,136,984. That still would have represented a decline from last year, but it wouldn’t have been as pronounced.

As I have noted throughout 2025 thus far, while most people are primarily concerned with the price of their home, it’s the sales data that remains the most significant in my mind.

Looking back at January, February, and March’s sales data, we noted that the sales figures were at or near all-time lows for those respective months:

January – 3rd fewest

February – fewest

March – fewest

This is from 2002 onward, since the city was too small to measure before then and have it represent an accurate comparison.

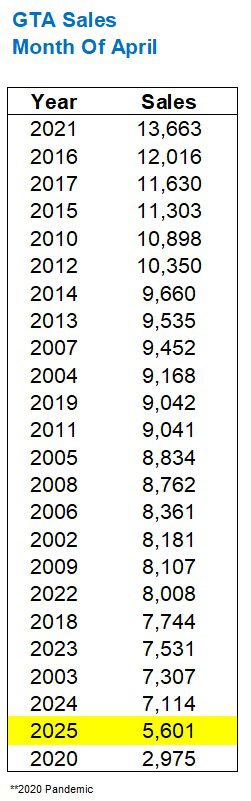

In April, we did not see sales figures follow the trend and represent the lowest ever.

It was the second-lowest ever:

Except that 2020 was the pandemic, hence my asterisk, and hence why I would offer that last month’s sales were the de facto lowest sales ever in the month of April.

And it’s not even close!

The previous low was, well, last year, with 7,114 sales.

So while last month represents the lowest sales ever, the second-lowest is 21.2% higher. That’s wild!

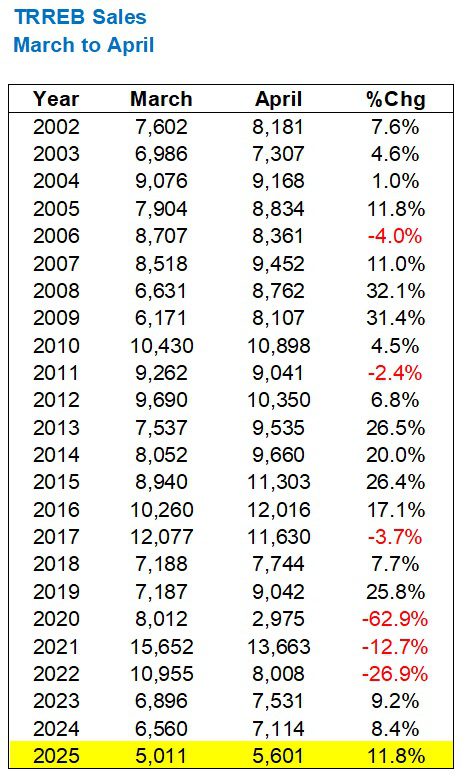

Month-over-month, the movement in sales was in line with the trend from 2023 and 2024:

This is where I would say that, while the market is “slow,” it’s not getting any slower. It’s not getting any “worse.” It is, at the very least, consistent.

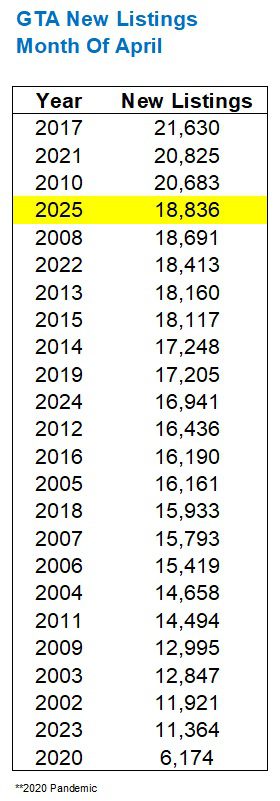

New listings checked in at 18,836, which is the fourth-most in any month of April:

Yes, it’s up from the 16,941 recorded in April of last year, which placed that figure middle-of-the-pack as far as April goes. But 16,941 to 18,836 isn’t that significant.

As for the monthly movement, that 9.1% increase in new listings was far lower than last year, much higher than the year before, but overall, not significant:

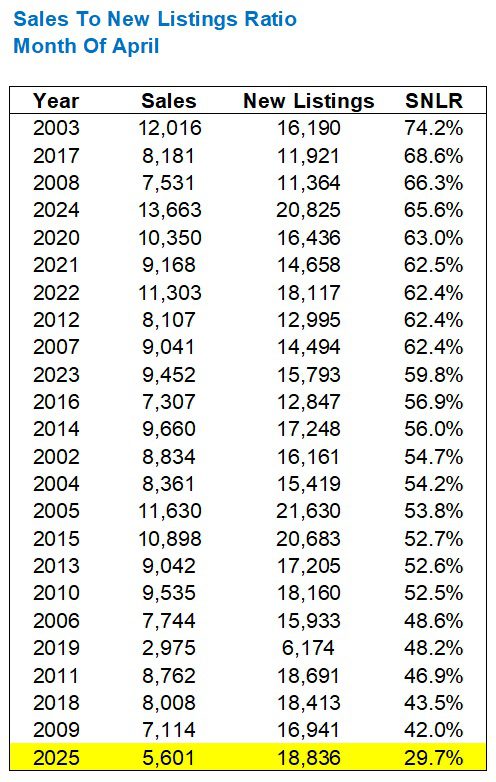

What is significant, however, is the relationship between sales and listings!

The absorption rate or sales-to-new-listing ratio (SNLR).

As far as April goes, this was the lowest of all time:

Once again, it’s not even close.

This was the theme in March as well, don’t forget.

In March, we saw an absorption rate of 29.0% which was even further behind the second-lowest on the list, which was 46.2%.

It almost makes the above gap – 29.7% versus 42.0%, look small by comparison.

Almost…

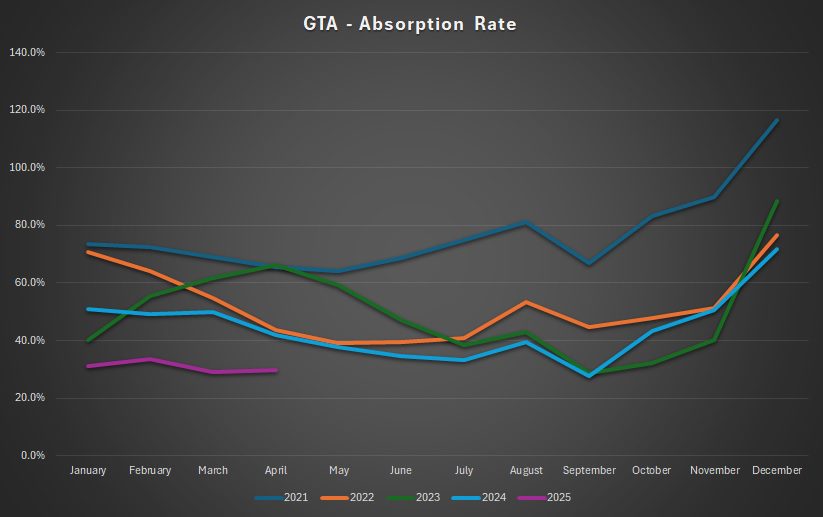

Now, let’s put this all together. Let’s monitor the absorption rate through 2025 and compare it to the previous four years:

Well, that’s saying something!

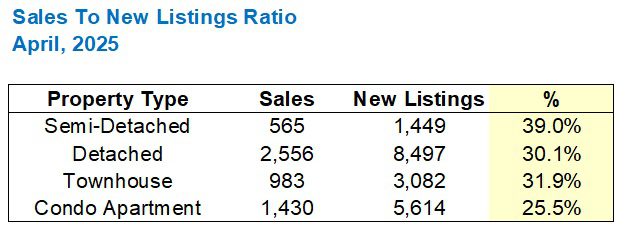

The absorption rate differs through the property type, however, as we noted last month.

Freehold is doing better than condominium; but what else is new?

So now you ask: what is my reason for optimism?

Well, I’m not looking to paint a rosy picture on this, nor am I going to suggest that we’re heading back to a seller’s market, but surely with a provincial and federal election out of the way, it’s fair suggest that perhaps the worst is behind us?

When Donald Trump announced his tariffs and the stock market plunged the next day, we have to remind ourselves that it was already sitting at an all-time high. If the DOW Jones is your measure, then let me ask you: will it regain the lost ground by the end of 2025?

Maybe. Maybe not. However, as we saw with the stock market plunge in March of 2020 during COVID, the initial shock gave way to a gradual gaining of lost momentum, and by the end of the year, all the lost ground had been made up. As history has shown, the DOW Jones has since gained upwards of 50% in four years’ time.

While I don’t expect the real estate market to follow suit in the same way, I do see a parallel between market shocks and market recoveries.

With the Bank of Canada likely to cut interest rates in June, an increase in consumer confidence could see a busy summer real estate market, much like in 2020 when the “lost” sales during the COVID-affected months of March, April, and May resulted in all-time high sales figures in July and August.

We won’t be seeing all time anythings this summer, but I do think that a little bit of consumer confidence will go a long way.

The sales data will be the most interesting story of 2025 when we look back at year’s end.

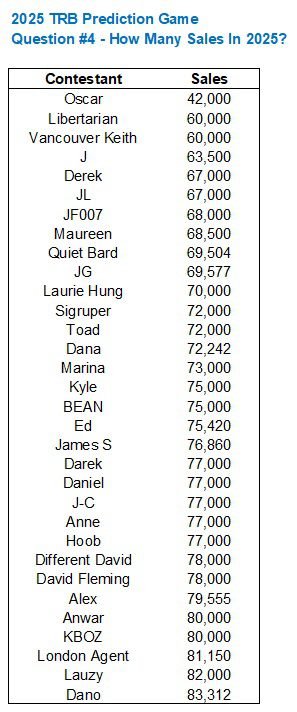

Hey, maybe it’s time to check in on the 2025 TRB Prediction Game?

As it pertains to sales, the 32 TRB readers who entered the contest predicted an average of 72,613 sales for 2025.

And who predicted the most?

Your favourite grouch: Oscar!

Have a great weekend, everybody!