Wondering how to find Airbnb for sale?

You’re not alone. Airbnb investments continue to thrive, making it one of the most attractive segments in today’s real estate market. According to Grand View Research, the US short-term vacation rental market was valued at approximately $68.64 million in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% through 2030.

With Airbnb’s global supply surpassing 8 million listings across over 150,000 cities, savvy investors are capitalizing on this explosive growth by securing profitable Airbnb properties.

However, succeeding in Airbnb investing isn’t simply about buying any available property. It’s about strategically choosing the right one.

A profitable Airbnb investment must match market demand, adhere to local regulations, and offer compelling amenities that attract consistent bookings and maximize occupancy rates. Selecting the wrong property can lead to vacancy struggles, poor reviews, and regulatory headaches, all of which erode your investment returns.

In this step-by-step investor’s guide, we’ll explore how to accurately pinpoint your ideal vacation rental property, use Mashvisor’s powerful tools to efficiently locate profitable Airbnb rentals, and highlight alternative strategies for discovering investment opportunities.

Additionally, we’ll cover essential factors like location analysis, local zoning laws, and seasonal demand fluctuations, ensuring you’re fully equipped to make informed, data-driven decisions.

Whether you’re a seasoned investor or just beginning your journey into Airbnb investments, this comprehensive guide will provide actionable insights to confidently navigate the market and secure properties that promise strong returns and long-term success.

Before You Buy, Find Your Ideal Vacation Property Type

Before diving into the Airbnb market, it’s crucial to identify the ideal vacation property that aligns with your investment goals. This involves analyzing potential earnings, understanding occupancy trends, evaluating property types and amenities, and exploring top-performing markets.

Analyze Potential Earnings Based on Bedrooms

The number of bedrooms in a property significantly influences its profitability on Airbnb. Larger properties can accommodate more guests, allowing for higher nightly rates. For instance, a three-bedroom home in a popular destination may command a premium price compared to a one-bedroom apartment.

Utilizing tools like Mashvisor’s Airbnb Calculator can provide accurate revenue estimates based on bedroom count, helping you make informed decisions.

Mashvisor’s Airbnb calculator

Check the Occupancy Rates of Each Property Type

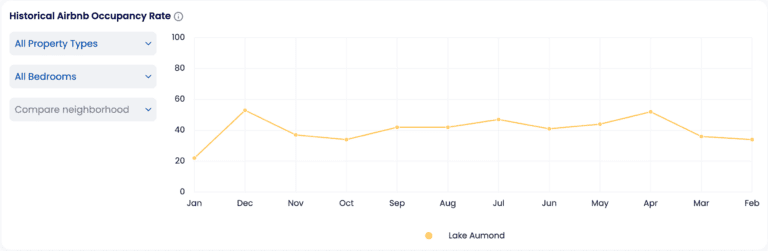

Understanding Airbnb occupancy rates by property type and bedroom count is crucial for maximizing your investment returns.

Smaller units, like studios and one-bedroom apartments, often achieve higher occupancy rates due to their affordability and appeal to solo travelers or couples. In contrast, larger properties may have lower occupancy but can command higher nightly rates, balancing the income potential.

Analyzing vacation rental availability trends helps in forecasting potential income and identifying peak booking periods. By aligning your property’s availability with market demand, you can optimize occupancy and revenue.

Mashvisor’s analytics platform can provide insights into occupancy patterns across different property types, enabling data-driven decisions for your Airbnb investment strategy.

Evaluate Property Types and Key Amenities

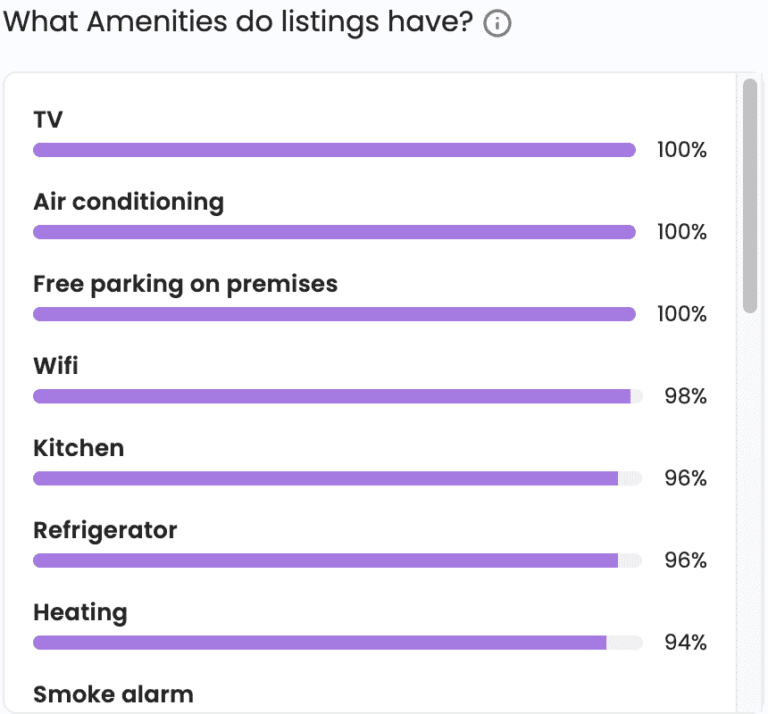

The type of property and its amenities play a significant role in attracting guests.

Popular vacation rental styles include condos, single-family homes, and cabins, each appealing to different traveler demographics. Essential amenities such as high-speed internet, fully equipped kitchens, and comfortable furnishings enhance guest experience and can lead to higher occupancy rates. Identifying properties that offer these features can boost your investment’s success.

Mashvisor displays the most common amenities in STRs in the same neighborhood of the property you’re viewing to identify trends and ensure your property meets guest expectations

Explore Top Airbnb Markets

Investing in the right location is paramount.

Top Airbnb markets often feature a combination of tourist attractions, business hubs, and favorable regulations. Short-term rental analytics tools can help you identify cities and neighborhoods with high demand and strong revenue potential. Mashvisor provides detailed market insights, assisting you in pinpointing the best areas for your investment.

By thoroughly assessing these factors, you can strategically approach how to find Airbnb for sale that aligns with your investment objectives. Leveraging data-driven tools and market analysis ensures you make informed decisions, setting the foundation for a successful Airbnb income property.

Using Mashvisor to Find Airbnb Investments

After pinpointing the ideal vacation property type that aligns with your investment strategy, the next critical step is streamlining your search process. Knowing how to find Airbnb for sale efficiently can make the difference between securing a profitable investment and missing out on prime opportunities.

Fortunately, Mashvisor simplifies this process by providing intuitive tools designed specifically for Airbnb investors. Here’s a step-by-step breakdown of how you can leverage Mashvisor to find Airbnb investments effectively:

Step 1: Conduct Preliminary Market Research

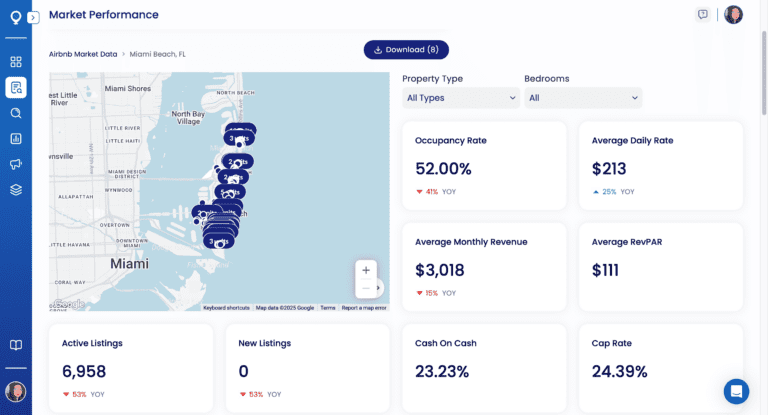

Before diving into specific listings, you must familiarize yourself with broader market insights and local conditions. Mashvisor’s powerful platform offers detailed market insights and comprehensive short-term rental analysis, helping you identify promising markets based on key performance indicators like occupancy rates, nightly pricing, and seasonal fluctuations.

When conducting preliminary market research, you can start with Mashvisor’s Market Performance page to get an overview of any city

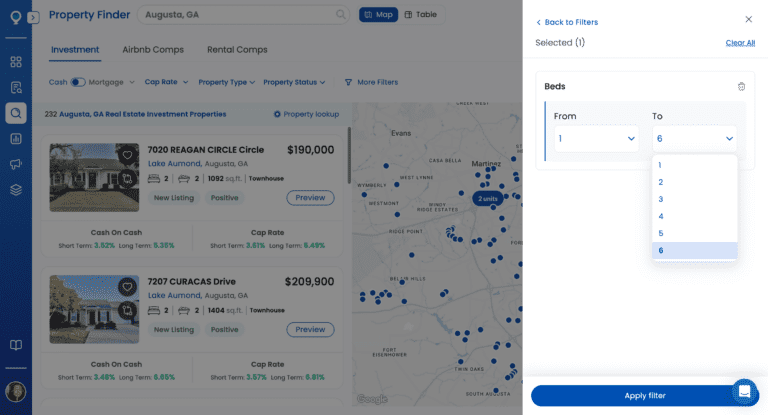

Step 2: Narrow Properties by Bedrooms

In the previous section, you learned your ideal vacation property type, so you know what kind of Airbnb you’re searching for. Using Mashvisor’s user-friendly property filter tools, you can easily target listings by bedroom count, a critical factor impacting potential earnings.

These investment property filters enable you to quickly identify properties that match your ideal investment profile and financial goals, providing clarity on projected revenue by bedroom count.

On Mashvisor’s Map Property Finder, filter your search by property type or number of bedrooms to make it faster for you to shortlist Airbnbs for sale

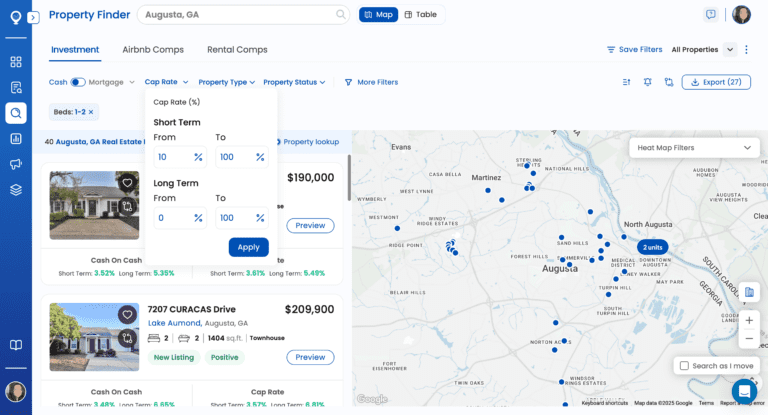

Step 3: Refine Search to Properties With High STR Cap Rate

When performing an Airbnb property search, consider the short-term rental (STR) cap rate. The capitalization rate, commonly known as “cap rate”, represents the expected annual return on your investment based on its net operating income and the property’s purchase price.

Focusing your search on investment property listings with higher cap rates ensures you’re targeting properties likely to deliver strong profitability and a quicker return on your investment.

Using Mashvisor, you can easily refine your property searches by filtering results specifically by STR cap rates. Set your preferred minimum cap rate percentage to instantly view properties that meet your financial expectations. This target approach streamlines your selection process, allowing you to swiftly identify and focus on the most promising Airbnb investments in your chosen market.

Narrow down your search further by only displaying specific property types or number of bedrooms with a minimum or maximum STR cap rate

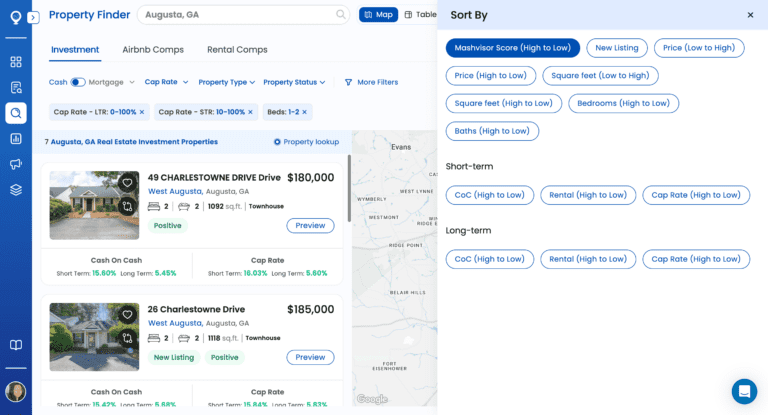

Step 4: Prioritize Your Airbnb Investment Options

With a refined list of potential properties, sort the results based on criteria like Mashvisor score, date listed, property price, and more. Prioritizing your options in this manner ensures you focus your efforts and resources on properties most likely to deliver strong returns.

Sort the filtered results by your selected metric so you can immediately see the properties that would be ideal investments for you

Step 5: Analyze Shortlisted Airbnb Listings

Finally, perform an in-depth Airbnb investment analysis on the top three to five properties on the list.

Mashvisor facilitates comprehensive property due diligence by providing critical data such as projected revenue, occupancy forecasts, expenses, and profitability estimates. With this detailed analysis, you can confidently move forward, fully informed and ready to secure your next successful Airbnb investment.

Alternative Ways to Discover Short-Term Rentals

Even with Mashvisor’s data tools, smart investors cast a wider net when learning how to find Airbnb for sale. The channels below help you source fresh Airbnb listings, uncover off-market properties, and sharpen your vacation rental investing pipeline through strategic real estate networking.

Leverage Reddit Communities

Active subreddits like r/realestateinvesting regularly surface success stories, market insights, and occasional deal leads from hosts looking to exit an asset. Jump into threads, share your criteria, and message posters privately to unlock prospects before they hit the MLS.

Search Zillow Listings

Use Zillow’s advanced filters—such as “vacation rental” or “STR permit”—to flag homes already operating as short-term rentals. Pair price filters with map view to zero in on tourist corridors and lakeside streets.

Join Relevant Facebook Groups

Communities like STR Homes for Sale (100k+ members) post turnkey Airbnbs, failed arbitrage units, and cabin portfolios daily. Engage sellers directly and set alerts so you’ll get real-time notifications on your phone.

Connect With Specialized Real Estate Agents

Platforms such as Rabbu match buyers with agents who close STR deals every week. These pros know zoning quirks, revenue comps, and reliable cleaners—intel that saves you research time.

Use Online Property Discovery Tools

Beyond Mashvisor, tools like AirDNA or Rabbu’s marketplace aggregate performance data and MLS feeds, giving you another lens to vet cap rates and nightly rates fast.

Launch Direct Mail Outreach

Well-crafted postcards or letters to absentee owners can surface off-market properties ripe for conversion to Airbnbs. According to Real Estate Investing Women, direct mail still averages higher response rates than most digital tactics.

Attend Real Estate Networking Events

Local meetups introduce you to wholesalers, lenders, and fellow hosts who swap leads over coffee. Weekly gatherings listed on Meetup.com boast more than one million members nationwide.

Explore Property Auction Platforms

Sites such as Auction.com list foreclosure and bank-owned homes that can be rehabbed into STR gems at below-market prices.

Engage Local Property Management Firms

Managers often know owners eager to sell profitable rentals. Marketplaces like CohostMarket help you connect with vetted firms for potential pocket listings.

Browse FSBO Listing Websites

ForSaleByOwner.com lets you negotiate directly with sellers, skipping agent fees and sometimes uncovering unique properties before broader exposure.

Consult Local Tourism Organizations

Destination marketing groups run “investor weekends” and publish reports on lodging gaps. These are excellent cues for neighborhoods hungry for new supply.

Collaborate With Title Companies

Title data services like BatchLeads provide fresh ownership records and equity positions, enabling precision targeting for your next mailer or cold-call campaign.

Combine these channels with Mashvisor’s analytics, and you’ll expand your funnel, source stronger deals, and deepen your market intelligence. These are all crucial for mastering how to find Airbnb for sale in any climate.

Essential Considerations for Airbnb Investors

Now that you know how to find Airbnb for sale and have probably even short-listed a few promising addresses, it’s time for a final reality check. The three checkpoints below separate high-yield Airbnbs from costly missteps. Pass each filter and you’ll head to closing with data-backed confidence.

Property Location Matters

A great location boosts nightly rates, keeps calendars full, and wins repeat guests. Our April 2025 market report shows leading short-term rental hubs such as Sweetwater (FL), Winnetka (CA), and Waianae (HI) each averaging $5,000-$8,000 in monthly STR income, well above $60k per year for a typical three-bed home. Markets that shine usually share three traits:

- Year-round tourism or business travel

- Limited hotel supply

- Supportive city policies

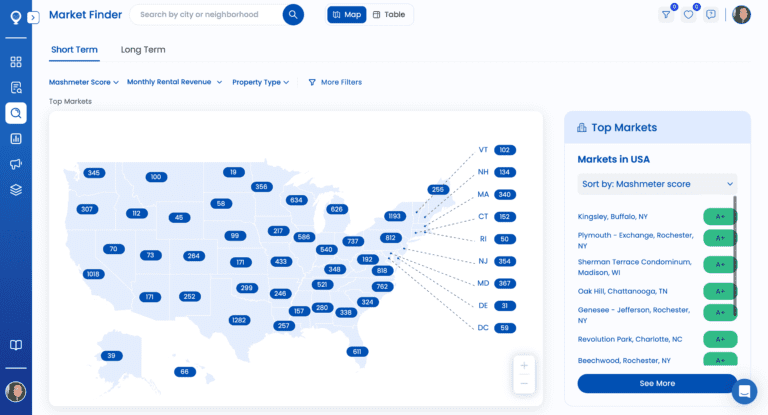

Mashvisor’s Market Finder ranks neighborhoods by overall investment potential, while the heatmap layers cap rate, cash-on-cash return, and listing price over every block. Use these tools to zero in on the exact streets where returns outpace the zip-code average.

Mashvisor’s Market Finder

Conclusion

Mastering how to find Airbnb for sale isn’t about luck; it’s about following a system.

- Identify the right property type by comparing bedroom counts, occupancy trends, amenities, and market-level demand.

- Let Mashvisor’s toolbox do the heavy lifting: use Market Finder and the heatmap to zero in on profitable zip codes, filter the Map Property Finder for high STR cap-rate investment property listings, and run every finalist through the Airbnb Calculator for airtight ROI projections.

- If on-platform supply feels thin, widen your funnel with Reddit leads, Zillow keywords, Facebook groups, agent partnerships, direct mail, and local networking to uncover off-market gems.

- Stress-test each deal against the three non-negotiables—prime location, compliant regulations, and season-proof demand—before you write an offer.

By combining these methods, you transform guesswork into data-backed strategy and position yourself to acquire an Airbnb income property that delivers consistent cash flow year after year.

Ready to put the plan into action? Sign up for Mashvisor today, explore our marketplace, and run your first deal analysis in minutes. Your next high-performing short-term rental is only a few clicks away. Start your investment journey now and watch your returns grow.

Mashvisor’s property details page provides important analytics to help you determine if the home you’re looking at would make a profitable Airbnb.