The fastest growing STR markets aren’t just headlines; they’re high-yield opportunities hiding in plain sight.

In 2025, shifting travel patterns, tighter supply chains, and traveler preferences for unique stays have redrawn the US short-term rental map. Whether you’re a first-time host or a seasoned investor expanding your portfolio, spotting these rapid-rise destinations early can mean the difference between average cash flow and outsized returns.

This guide cuts through the noise with Mashvisor’s proprietary data to show you:

- How to measure growth in short-term rental markets – the metrics that separate hype from sustainable momentum.

- 2025 US STR trends – three macro shifts reshaping revenue potential this year.

- The fastest growing US markets – from supply explosions to demand-driven hotbeds where bookings surge faster than new listings.

- Mashvisor’s methodology – a transparent look at the analytics engine behind our market picks.

Ready to identify the next breakout city before everyone else does? Let’s dive into the numbers and find your next winning investment.

Key Takeaways

- Track the right numbers to uncover the fastest growing STR markets. You can turn raw data into clear investment signals by monitoring these seven metrics: demand, supply, occupancy, ADR, RevPAR, review velocity, and regulation score.

- 2025’s fastest growing STR markets emerge where policy stabilizes and travel patterns shift. Cities like San Gabriel, Davenport, and Winter Haven show how regulation relief, theme-park traffic, or mid-term remote work can ignite rapid growth.

- Year-over-year analysis keeps you ahead of the curve. Comparing May 2025 to May 2024 highlights markets where demand climbs faster than listings, letting investors raise rates and lock in higher cash flow before headlines catch up.

How to Measure Growth in Short-Term Rental Markets

Growth sounds exciting, but it’s only real if you can track it with clear numbers. Below are the core metrics you should use to spot the fastest growing STR markets and flag emerging Airbnb cities in the US before they hit every headline.

Demand Growth (Nights Booked YoY)

Count the total nights guests booked this year and compare them with last year. A double-digit jump shows that traveler interest is heating up, which may signal room for higher rates.

Supply Growth (Active Listings YoY)

Check how many active listings a market adds month over month. Rapid supply growth can be healthy if bookings keep pace. If supply outruns demand, nightly rates and occupancy often slip.

Occupancy Rate Trend

An upward trend in the percentage of booked nights tells you new listings aren’t flooding the market. Flat or falling occupancy, even with rising demand, hints at oversupply.

Average Daily Rate (ADR) Change

A rising ADR means hosts can charge more without scaring guests away. Flat ADRs in a booming market might signal price resistance, or a chance to upgrade amenities and increase rates.

Revenue per Available Rental (RevPAR)

RevPAR blends occupancy and ADR into one powerful metric. If RevPAR climbs while supply expands, you’ve likely found a truly strong market.

Review Velocity

More fresh reviews per listing point to steady bookings and satisfied guests, which are two early signals of durability.

Regulation Score

A friendly STR policy keeps growth alive. Mashvisor flags cities with positive, neutral, or negative ratings so you’re never blindsided.

With these seven metrics, you’ll see growth coming instead of guessing. Use them to confirm a market’s momentum, price your rentals smarter, and pick investments that keep cash flowing long after the buzz fades.

US Short-Term Rental Trends (2025)

America’s US vacation rental market trends show a year of cooling momentum rather than collapse. Thankfully, you can still ride the wave toward the fastest growing STR markets instead of getting caught where growth has stalled.

Demand Softens and Guests Book Later

Our spring snapshot puts national Airbnb occupancy rates at 50%, down from 57% in 2024. This shows that traveler demand is easing as new listings crowd popular areas. Phocuswright analysts add that many travelers are sliding back to hotels now that pandemic habits have faded, trimming early booking volumes and forcing hosts to rely on last-minute reservations.

So make sure to adopt dynamic pricing, attract last-minute guests, and focus on markets where demand continues to outpace new supply.

Supply Growth Taps the Brakes Under New Rules

Regulation, high rates, and zoning fights are finally slowing the listing spree.

Our May 2025 location report revealed that national supply decreased by 23% compared to the previous year. And in New York City, Local Law 18 erased 92% of STR listings in a single year after being adopted in 2022 and prompted copycat debates nationwide. In the last 12 months, its Airbnb listings went down by 55%.

However, this trend could present an opportunity to new investors and hosts who have short-term rentals in highly regulated cities. The markets that keep supply in check while regulations stabilize will likely climb the list of fastest growing STR markets.

Remote Work Evolves Into Longer, Secondary-City Stays

Extended “work-from-anywhere” trips aren’t dead, they’re maturing.

Touch Stay reports a surge in 30-plus-day bookings and rising interest in rural and secondary destinations as travelers hunt for authentic settings and value. MBO Partner’s analysis shows digital nomads now make up over 18 million Americans, creating steady, lower-turnover income for hosts who offer strong Wi-Fi and dedicated workspaces.

Yet the pool is tightening: Business Insider notes that stricter return-to-office mandates are shrinking the free-roaming nomad crowd, and Flex Index says 33% of US employers require full-time office attendance in 2025, up from last year.

Investors who mix mid-term stay amenities with savvy weekday pricing can capture this evolving demand stream and push their properties to the forefront of tomorrow’s fastest growing STR markets.

Fastest Growing US Short-Term Rental Markets (2025)

Below are the cities that rose fastest based on Mashvisor’s May 2025 location report, split by supply spikes, short-term rental demand growth, and “goldilocks” markets where bookings are climbing faster than new listings. Together they form the newest cluster of fastest growing STR markets to watch this year.

Supply Growth Leaders

| Rank | City | YoY Supply Growth* |

| 1 | San Gabriel, CA | +709% |

| 2 | Davenport, FL | +707% |

| 3 | Saratoga, NY | +564% |

| 4 | Wilmington, NC | +555% |

| 5 | Lawrenceville, PA | +543% |

*YoY = May 2025 vs. May 2024 active listings, Mashvisor location report.

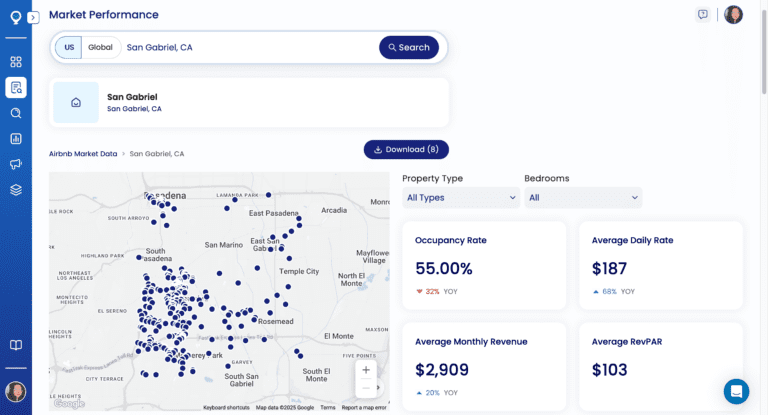

Real-time market performance of San Gabriel, CA

What’s driving the surge?

- San Gabriel benefits from new ADU rules near Los Angeles, plus rental-arbitrage buzz.

- Davenport sits 10 minutes from Walt Disney World, and brand-new vacation-home subdivisions are opening every quarter.

- Saratoga adds stock each racing season to serve summer crowds.

- Wilmington’s coastal revival and film-industry boom have lured investors to Carolina Beach and Wrightsville.

- Lawrenceville is Pittsburgh’s startup district; warehouse loft conversions are pouring into Airbnb stock.

Demand Growth Leaders

| Rank | City | YoY Demand Growth* |

| 1 | Lake Clarke Shores, FL | +49% |

| 2 | Kendall, FL | +45% |

| 3 | Charleston, SC | +33% |

| 4 | Temple, TX | +31% |

| 5 | Washington, DC | +31% |

*Measured by the increase in Airbnb occupancy percentage points.

Key forces at play

- Palm-Beach-area lake life lifts Lake Clarke Shores bookings for family groups.

- Kendall’s healthcare corridor and proximity to Miami nightlife keep calendars full year-round.

- Tourism, food, and cruise departures sustain Charleston, even as regulations tighten downtown.

- Temple straddles the I-35 tech corridor and Fort Cavazos, feeding steady corporate and military travel.

- Business travel and conferences finally rebounded in DC, sending occupancy back above pre-pandemic levels.

Markets Where Demand Outpaces Supply

| City | Supply Growth | Demand Growth |

| Winter Haven, FL | +1.9% | +14% |

| Whittier, CA | +2.6% | +5% |

| Morehead City, NC | +0.9% | +2% |

| Port Richey, FL | +1.8% | +2% |

| Spring Hill, FL | +1.5% | +2% |

Low listing growth plus rising bookings translate to tighter occupancy and room to raise rates, ideal conditions for new entrants.

A Closer Look

Supply leaders often sit near bigger, pricier hubs often sit near bigger, pricier hubs. Investors flood in when regulations stay friendly and nightly rates still pencil: that’s exactly what happened in San Gabriel after LA’s crackdown moved hosts outward, and in Davenport, where new resort subdivisions sprang up once interest rates eased.

Demand leaders, meanwhile, rely on durable traveler pipelines. Think Charleston’s year-round heritage tourism or Washington, DC’s return of lobbyists and convention traffic.

Finally, the “outpacing” group shows how modest, suburban towns (Winter Haven, Whittier) can be profitable when new listings stall but theme-park day-trippers or local events keep booking momentum high. Spotting the same pattern early is how you’ll identify tomorrow’s fastest growing STR markets before everyone else.

Our Methodology: How Mashvisor Identifies Growth Markets

At Mashvisor, we know that reliable data (not hunches) reveal the fastest-growing STR markets. Here’s the simple, transparent process behind this 2025 report.

1. A massive, verified data lake

We pull nightly performance from our proprietary database of 2 million+ US short-term rentals. This feed combines Airbnb data and public records, so our numbers reflect what guests actually book and pay.

2. Matching identical windows

To remove seasonality noise, we compared two equal snapshots: May 2025 versus May 2024. Looking at the same month each year means spring break, graduations, and holiday timing don’t skew results.

3. Minimum market size

Only cities or towns with 100 or more active Airbnb listings as of May 2025 made the cut. Smaller pools can swing wildly on a handful of properties, masking true trends.

4. Supply change calculation

We measured the number of active listings each market added or lost over the 12-month span and expressed that as a percentage jump or drop. This forms the supply side of our Airbnb supply vs demand analysis.

5. Demand change calculation

For demand, we focused on occupancy, or how often units were booked. We subtracted each market’s May 2024 Airbnb occupancy rate from its May 2025 rate. A positive result signals more guest nights earned without inflating rates alone.

6. Ranking and cross-checks

Markets were ranked separately for supply growth and demand growth and cross-checked for anomalies (e.g., sudden regulatory shifts). We also flagged “goldilocks” cities where demand rose faster than supply, creating pricing power for hosts.

By grounding every figure in year-over-year math and setting strict eligibility rules, we ensure our lists highlight genuine momentum (not one-off events) so you can act on clean insights with confidence.

Conclusion

The 2025 landscape proves that opportunity favors investors who read the numbers, not noise. National averages may hint at cooling demand, yet our year-over-year snapshot reveals pockets of remarkable momentum.

Supply growth leaders like San Gabriel and Davenport demonstrate how relaxed zoning and tourism magnets can add hundreds of new listings without saturating nightly rates.

Demand growth leaders (Lake Clarke Shores, Kendall, Charleston, Temple, and Washington, DC) show that healthcare hubs, heritage tourism, and business travel still pack booking calendars.

Finally, “goldilocks” towns such as Winter Haven and Whittier illustrate the sweet spot where bookings rise faster than beds, giving hosts room to push prices.

What ties these stories together is a disciplined, data-first approach. We tapped Mashvisor’s proprietary database of more than two million US listings, filtered out noise by requiring at least 100 active properties per market, and ran a clean May-to-May comparison. The result is a short-term rental growth forecast you can trust, grounded in occupancy shifts instead of gut feelings.

Use these insights to refine your search criteria, fine-tune dynamic pricing, or pivot to mid-term rentals where traveler demand is maturing.

Above all, keep your dashboard refreshed. Regulations evolve, traveler preferences shift, and today’s headline city may cool tomorrow. Mashvisor’s real-time analytics help you stay ahead, so you can secure deals in the fastest growing STR markets before the competition even knows they exist.

Ready to act? Run your next market scan in Mashvisor, crunch the numbers with our investment calculator, and turn this forecast into your profitable year yet.